To help clients solve retirement income needs over time, Protective%%®%% Investors Benefit Advisory Variable Annuity NY offers the optional SecurePay Pro benefit. This optional benefit offers potential benefit base growth and guaranteed lifetime income.

Why add SecurePay Pro benefit to Protective Investors Benefit Advisory Variable Annuity NY?

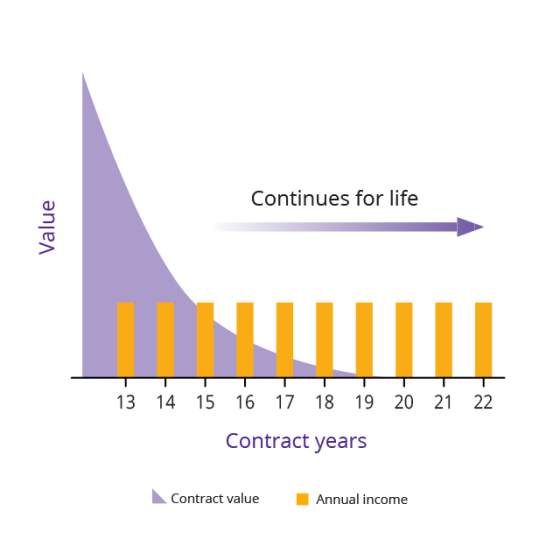

SecurePay Pro benefit combines potential market-driven growth with guarantees to ensure protected lifetime income that retirees won’t outlive.

Growth potential

Flexible timing feature

Long term increases

How SecurePay Pro benefit works

More people are retiring earlier than planned, and it s not always by choice. Whether it s due to health or employment circumstances, SecurePay Pro benefit can help create a protected income stream for life.

Investing with SecurePay Pro benefit

Adding SecurePay Pro benefit to Protective Investors Benefit Advisory Variable Annuity NY allows clients to leverage quality investment options. Meet their growth goals and investment risk tolerance with a tailored approach made possible through our multiple allocation options, shaped by guidelines to support guarantees. See the details on our Investing with SecurePay Pro page.

Introduce clients to SecurePay Pro benefit

Use this flyer with clients to demonstrate how this benefit works to help them secure retirement income for life.

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

¹ RightTime is available for an additional 0.1%.

² If your Contract Value is reduced to zero due to benefit withdrawals, your contract will be annuitized and you will begin receiving monthly income payments in an amount equal to your last annual withdrawal amount divided by 12. If your contract value falls to zero due to excess withdrawals the rider will terminate and payments will end.

Protective refers to Protective Life and Annuity Insurance Company (PLAIC), Birmingham, AL. Variable annuities are distributed by Investment Distributors, Inc. (IDI), a broker-dealer and principal underwriter of registered products issued by PLAIC, its affiliate. IDI is located in Birmingham, AL. Product guarantees are backed by the financial strength and claims-paying ability of PLAIC. Protective® is a registered trademark of Protective Life Insurance Company (PLICO). The Protective trademarks, logos, and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits are provided under rider form number VDA-A-6057.

Variable annuities are long‐term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.6031161.09.24

² If your Contract Value is reduced to zero due to benefit withdrawals, your contract will be annuitized and you will begin receiving monthly income payments in an amount equal to your last annual withdrawal amount divided by 12. If your contract value falls to zero due to excess withdrawals the rider will terminate and payments will end.

Protective refers to Protective Life and Annuity Insurance Company (PLAIC), Birmingham, AL. Variable annuities are distributed by Investment Distributors, Inc. (IDI), a broker-dealer and principal underwriter of registered products issued by PLAIC, its affiliate. IDI is located in Birmingham, AL. Product guarantees are backed by the financial strength and claims-paying ability of PLAIC. Protective® is a registered trademark of Protective Life Insurance Company (PLICO). The Protective trademarks, logos, and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits are provided under rider form number VDA-A-6057.

Variable annuities are long‐term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a variable annuity, any optional protected lifetime income benefit and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read prospectuses carefully before investing. Prospectuses may be obtained by contacting Protective at 800-456-6330.

WEB.6031161.09.24

To exercise your privacy choices,

To exercise your privacy choices,