Help clients transfer wealth more efficiently with this fee-based variable annuity solution that offers two death benefit options.

Death benefit options for unique legacy goals

Clients can choose between a standard or enhanced death benefit option.

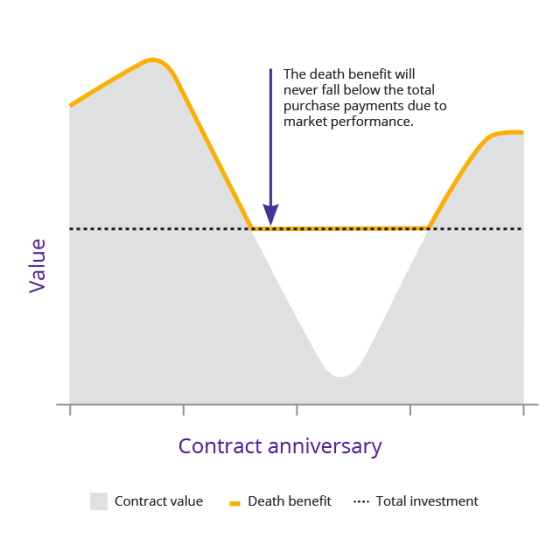

Return of Purchase Payments enhanced death benefit

With our Return of Purchase Payments death benefit, if your client passes away before starting annuity income payments, their beneficiaries will receive the greater of the contract value or total investment in the variable annuity, less an adjustment for each prior withdrawal. This benefit is available from ages 0 to 85 and costs 0.2% (annualized).

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

When a withdrawal is made, an adjustment is made to the death benefit in the same proportion to the amount withdrawn, reducing the contract value. The death benefit

option must be selected when the contract is issued and it cannot be changed. If the variable annuity contract is annuitized, the death benefit is no longer payable. If the

owner, or the annuitant if a non natural person is the owner, pass away during the annuitization payout phase, the beneficiary may receive additional guaranteed income

payments, depending on which payout option is selected.

Protective does not offer or provide investment, fiduciary, financial, legal or tax advice or act in a fiduciary capacity for any client. Clients should consult with their investment advisor, attorney or tax advisor as needed.

Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits provided under rider form number VDA-A-6057.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, advisory fees and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by calling PLAIC at 800-456-6330.

WEB.6029695.09.24

Protective does not offer or provide investment, fiduciary, financial, legal or tax advice or act in a fiduciary capacity for any client. Clients should consult with their investment advisor, attorney or tax advisor as needed.

Protective Investors Benefit Advisory Variable Annuity NY is a flexible premium deferred variable and fixed annuity contract issued by PLAIC in New York under policy form series VDA-A-2006-500. SecurePay Pro benefits provided under rider form number VDA-A-6057.

Variable annuities are long-term investments intended for retirement planning and involve market risk and the possible loss of principal. Investments in variable annuities are subject to fees and changes from the insurance company and the investment managers.

Withdrawals reduce the annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals may be subject to income tax and, if taken prior to age 59½, an additional 10% IRS tax penalty may apply. More frequent withdrawals may reduce earnings more than annual withdrawals.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, advisory fees and the underlying investment options before investing. This and other information is contained in the prospectus for a variable annuity and its underlying investment options. Investors should read the prospectus carefully before investing. Prospectuses may be obtained by calling PLAIC at 800-456-6330.

WEB.6029695.09.24

To exercise your privacy choices,

To exercise your privacy choices,